Credit Card Stupidity

TL;DR: The merchant naming rules on credit card transaction records are way too loose. This a little rant about time I have wasted as a result.

I no longer carry cash. Just credit cards.

I assume I'm pretty normal in that regard.

Besides the convenience of not having to go to a bank or ATM regularly, I like the record of payment that accompanies each digital transaction.

What I don't like, is the frequency with which my main card is cancelled and re-issued due to fraudulent charges.

It seems to occur pretty much annually.

Going without my preferred credit card for a week is inconvenient.

Also a pain are the various utilities and services who invariably start complaining (or simply stop functioning) after my card is re-issued.

It's an annoying game of "whack-a-mole" that persists for a month or so as charges to stored copies of my (now defunct) credit card fail.

Maybe it's a first world problem.

I'm starting to get better about remembering which services require my card, and proactively updating them.

It's still annoying. Equally so the fact that I am never told anything further about the fraud. Was it something I did? Could I modify my habits in some way to avoid further problems? Who the fuck knows. 🤷

💳💳💳💳

But here is something that should be fixed: The ridiculously opaque naming of vendors on my bank statements.

Too often when I check my statements I see names I don't recognize. I get why it happens. The merchant operating a certain business does not necessarily have the same "doing business as"1 name as the storefront. I can buy from some well known franchise, only to be charged by some completely unknown trading company.

This, frankly, is bullshit.

How hard can it be to enforce transparent/traceable merchant naming rules for these transactions?

If I buy lunch from "Delish Kebabs"2 why the fuck do I need to spend 15 minutes googling "Charma Plans, as Trustee for Kartoosh Family Trust" in order to intuit where I was shopping?

And while I'm at it, would it be all that hard to add an accurate street address for the purchase?

Take this recent example.

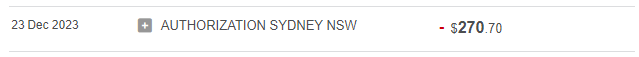

I was reconciling my statement for the previous quarter (BAS time, yay!). I came across this transaction:

It was from about three months previous. I had no idea what it might be.

The date indicated it had occurred while I was overseas on a family holiday. You know, when you are spending money in all sorts of places you don't regularly visit, and could perhaps be forgiven for forgetting what you spent where. Given exchange rates, you're also dealing with unfamiliar numeric quantities. Was $270 the cost of a night's stay at a hotel, a family meal at a restaurant? Groceries? A tank of petrol? Theatre tickets?

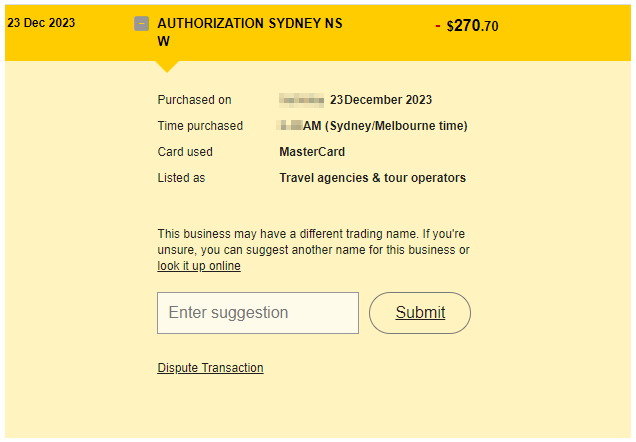

It was a digital transaction, I'm expecting a detailed breadcrumb trail. Helpfully, my bank's online listing has a little "more info" button to click on. It yields the following:

Hmmm. Disappointing.

There is a clickable "look it up online" link. That's nice. Except, it literally just performs a search on Google for the name.

Thanks bank. That's helpful. 😒 You try googling "Authorization Sydney NSW" and see what you get.

Not to fear. I'd simply visit my local branch and ask someone to look up the transaction for me.

The cheerful assistant got me to pull up the record on my phone. Then she clicked on the link.

That was the moment I knew I was completely fucked.

She did have one solution.

I could dispute the transaction.

Unfortunately, that did have a teensy side-effect, they would need to cancel and re-issue my card.

After agreeing that the nuclear option was probably not yet3 required, I left. Accompanied by some further sage advice. What I really needed to do was contact every merchant I had dealt with on that 2 week holiday and ask them if they knew what the charge might be.

I don't claim to be an expert on customer service. However, if my job required me to deliver such exquisitely impractical advice accompanied by a sincere "you're welcome" smile, I think I might slice my own wrists.

💳💳💳💳

I'm ashamed to say that I did make a bit of an effort to contact some merchants. After getting myself into a completely circular customer-service trap (of Pythonesque proportions) at Booking.com I realized I'd probably have to concede defeat.

I was several days, and multiple hours into this saga by now. I was no closer to knowing whether the $270 charge was fraudulent or not. The only guaranteed solution was to cancel the card. It would not be a cost-free solution - I'd have to deal with the further headache and time-wasting that would invariably ensue.

Pushing the words "sunk cost fallacy"4 out of my mind, I thought "Screw it, I've come this far..."

Fortunately, my wife suggested I go over my emails again. And sure enough, I finally found the transaction. A hotel room booked through Expedia.com.au.

Fuck.

If you are the normal internet forum denizen you will be saying "Duh, obviously, why didn't you check there first?"

To which I would reply:

- Fuck you.

- Fair question. The answer probably lies in a combination of factors, relating to haphazard record keeping stemming from a multiplicity of payment methods, communication media, currency denominations, overloaded brain cells, elapsed time, and uncommon spending patterns.

As normal, everyone has 20/20 hindsight.

Ultimately it's irrelevant.

How is it acceptable for a company of Expedia's size to register a transaction using the merchant name "AUTHORIZATION SYDNEY NSW"? 🤬

I won't lie, the methodical rigor of my record searching left much to be desired. Degraded by my frustration at having to do it all.

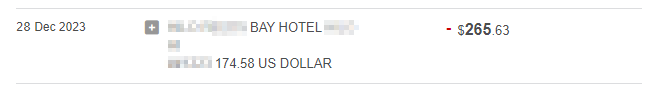

Just in case you think it's all easy-peasy take a look at the following transaction. .

No way I could mistake what it was. Also booked through Expedia.com.au 🤯.

For a hotel the day before the hotel stay in question.

Note the 5 day difference in between the two charges showing on my statement. There's actually a reason for that (I now know): one I booked "pre-paid" and one I booked "pay-on-site". Why did I do it that way? Who knows, or cares. If this is important, I'd expect it to be recorded in the transaction record.

💳💳💳💳

It remains a source of amazement to me that my bank seems to have no ability to research a transaction they present to me. Really, your solution is to Google for answers? How embarrassing.

Is my bank hopeless? Or do credit card companies deliver basic information about transactions only on a need-to-know basis? If so, I guess my bank (despite being the largest bank, and the second largest company in Australia) doesn't need to know. Is everyone (except me) ok with this?

Maybe credit cards are such a ridiculous cash-cow 🐮 that no-one wants to rock the boat.

It's 🐂💩.

💳💳💳💳

Business names, trading names and legal names - business.gov.au↩

A fictional example.↩

There were no other unusual transactions in the record, and I was not convinced the transaction was fraudulent.↩

The sunk cost fallacy is a psychological barrier that ties people to unsuccessful endeavors simply because they've committed resources to it. investopedia.com↩